mississippi state income tax rate 2020

The most significant are its income and sales taxes. Mississippi is very tax-friendly for retirees.

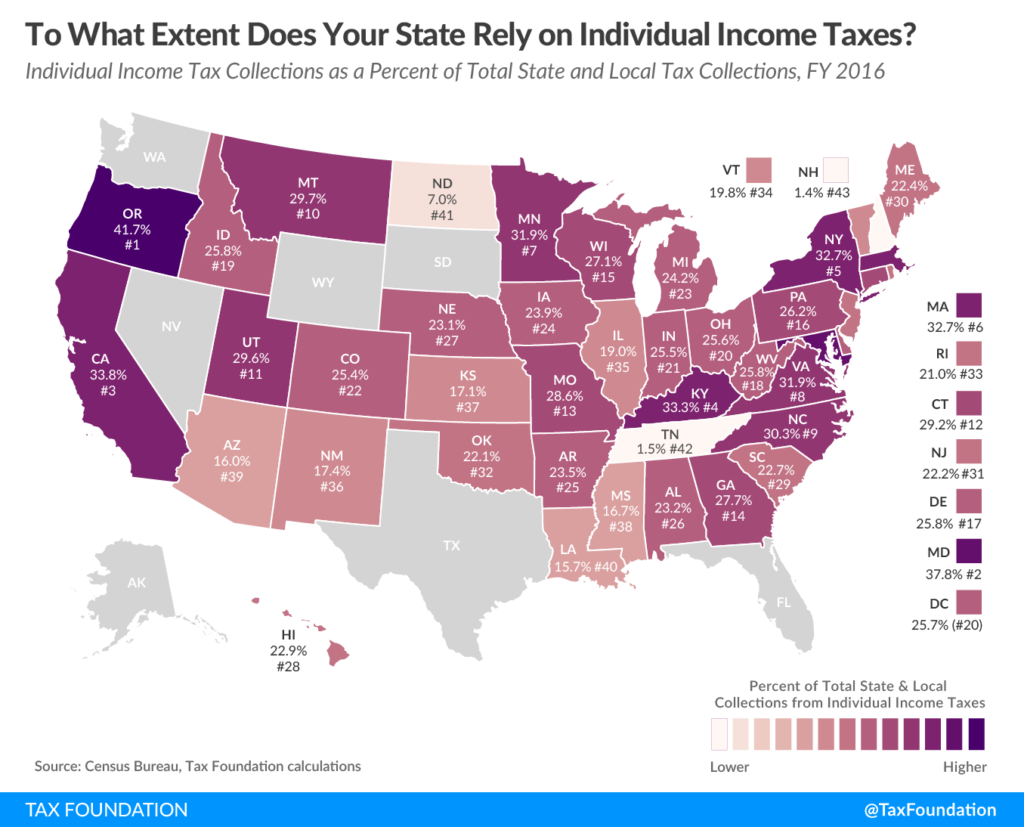

State Tax Levels In The United States Wikipedia

Tax rate of 4 on taxable income between 5001 and.

. 3 on the next 2000 of. Mississippi has a graduated individual income tax with rates ranging from 400 percent to 500 percent. EITCucator - Earned Income Tax Credit.

HOHucator - Tax Tool. 71-661 Installment Agreement. Combined Filers - Filing and Payment Procedures.

STATucator - Filing Status. There is no tax schedule for Mississippi income taxes. For single taxpayers living and working in the state of Mississippi.

The state does not tax Social Security benefits income from public or private pensions or withdrawals from retirement accounts. 80-105 Resident Return. 80-106 IndividualFiduciary Income Tax Voucher.

Eligible Charitable Organizations Information. The Mississippi state government collects several types of taxes. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in april 2020.

Box 23050 Jackson MS 39225-3050. Hurricane Katrina Information. Mississippi has a graduated tax rate.

80-100 Individual Income Tax Instructions. PENALTYucator - Late Filing Payment Penalties. Annual Use Tax Modernization Expenditure Reports will now be submitted online through the Mississippi Department of Revenues TAP website tapdormsgov.

The graduated income tax rate is. There is no tax schedule for Mississippi income taxes. Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5000 spread across three tax brackets.

Mississippi has a graduated tax rate. Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least 2001. Married taxpayers must make more than 16600 plus 1500 for each.

3 on the next 1000 of taxable income. 80-107 IncomeWithholding Tax. 0 on the first 4000 of taxable income.

All other income tax returns P. 4 on the next 5000 of taxable income. How do I compute the income tax due.

Corporate and partnership income tax. How to Calculate 2020 Mississippi State Income Tax by Using State Income Tax Table. These rates are the same for individuals and businesses.

The personal income tax which has a top rate of. For single taxpayers your gross income must be more than 8300 plus 1500 for each dependent. Mailing Address Information.

This means that these brackets applied to all income earned in 2019 and the. Mississippi has a graduated income tax rate and is computed as follows. Detailed Mississippi state income tax rates and brackets are available on.

The graduated income tax rate is. If you are receiving a refund PO. 5 on all t See more.

Box 23058 Jackson MS 39225-3058. Mississippi income tax rate and tax brackets shown in the table below are based on income earned between january 1 2020 through december 31 2020. 0 on the first 3000 of taxable income.

Find your pretax deductions including 401K flexible account. Find your income exemptions. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022.

These rates are the same for individuals and businesses. Mississippi has three marginal. Tax rate of 0 on the first 5000 of taxable income.

Mississippi also has a 400 to 500 percent corporate income tax rate.

Will Mississippi Join The No Income Tax Club

Mississippi Still Has Worst Poverty Household Income Mississippi Today

State W 4 Form Detailed Withholding Forms By State Chart

Mississippi State Income Tax Ms Tax Calculator Community Tax

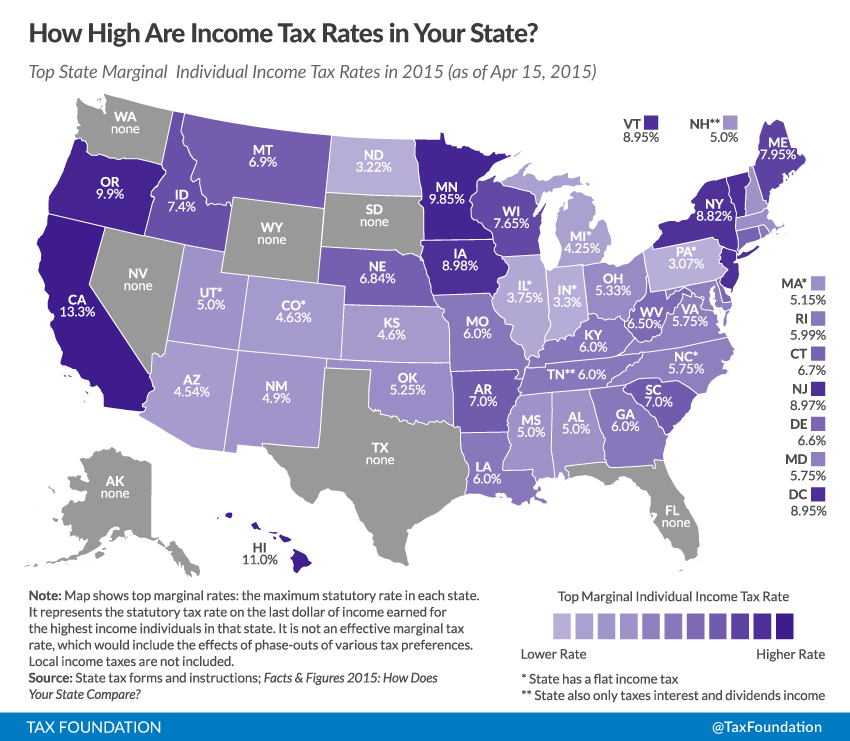

How High Are Income Tax Rates In Your State Tax Foundation

Mississippi State Income Tax Ms Tax Calculator Community Tax

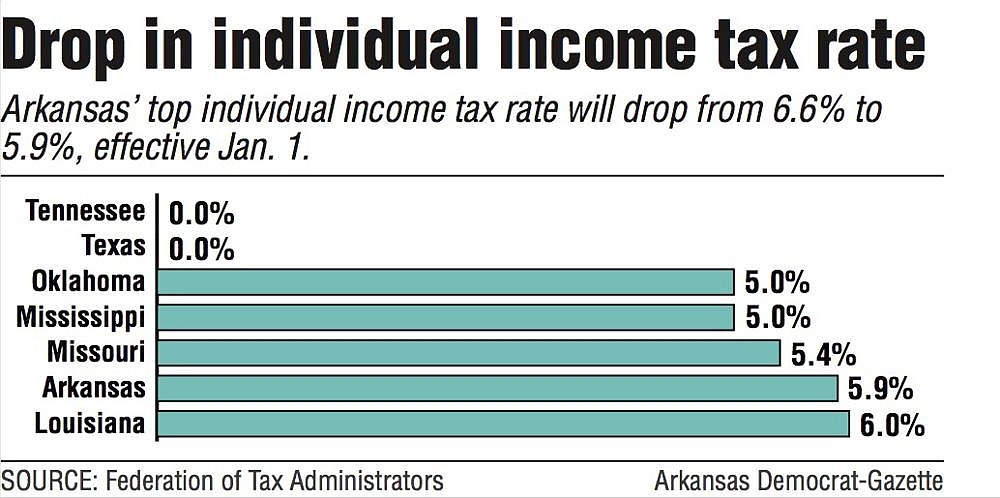

State S Top Income Tax Rate Dips To 5 9 Today

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Gov Reeves Signs 524 Million Tax Cut As Education Infrastructure Funding Woes Remain Jackson Free Press Jackson Ms

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog

Mississippi State Tax Tables 2020 Us Icalculator

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

Lawmakers Strike A Deal On Historic Cut Of Mississippi State Income Tax Mississippi Politics And News Y All Politics

Gov Walz S Corporate Income Tax Hike Would Give Mn Highest Starting Rate Of Corporate Income Tax Faced By Smaller Businesses In The U S American Experiment

How To Calculate Income Tax In Excel

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Every State With A Progressive Tax Also Taxes Retirement Income

Mississippi Income Tax Calculator Smartasset

How Do State And Local Individual Income Taxes Work Tax Policy Center